Ethereum And Bitcoin Market Cap Insights And Analysis

With ethereum and bitcoin market cap at the forefront, the cryptocurrency landscape continues to evolve, capturing the interest of investors and tech enthusiasts alike. As two of the most prominent players in the digital currency realm, understanding their market dynamics is crucial for anyone looking to navigate this exciting yet volatile space.

This overview delves into the fundamental differences between Ethereum and Bitcoin, examines their historical market cap trends, and highlights their unique use cases. By exploring these aspects, we can better grasp how each cryptocurrency positions itself within the broader financial ecosystem.

Overview of Ethereum and Bitcoin

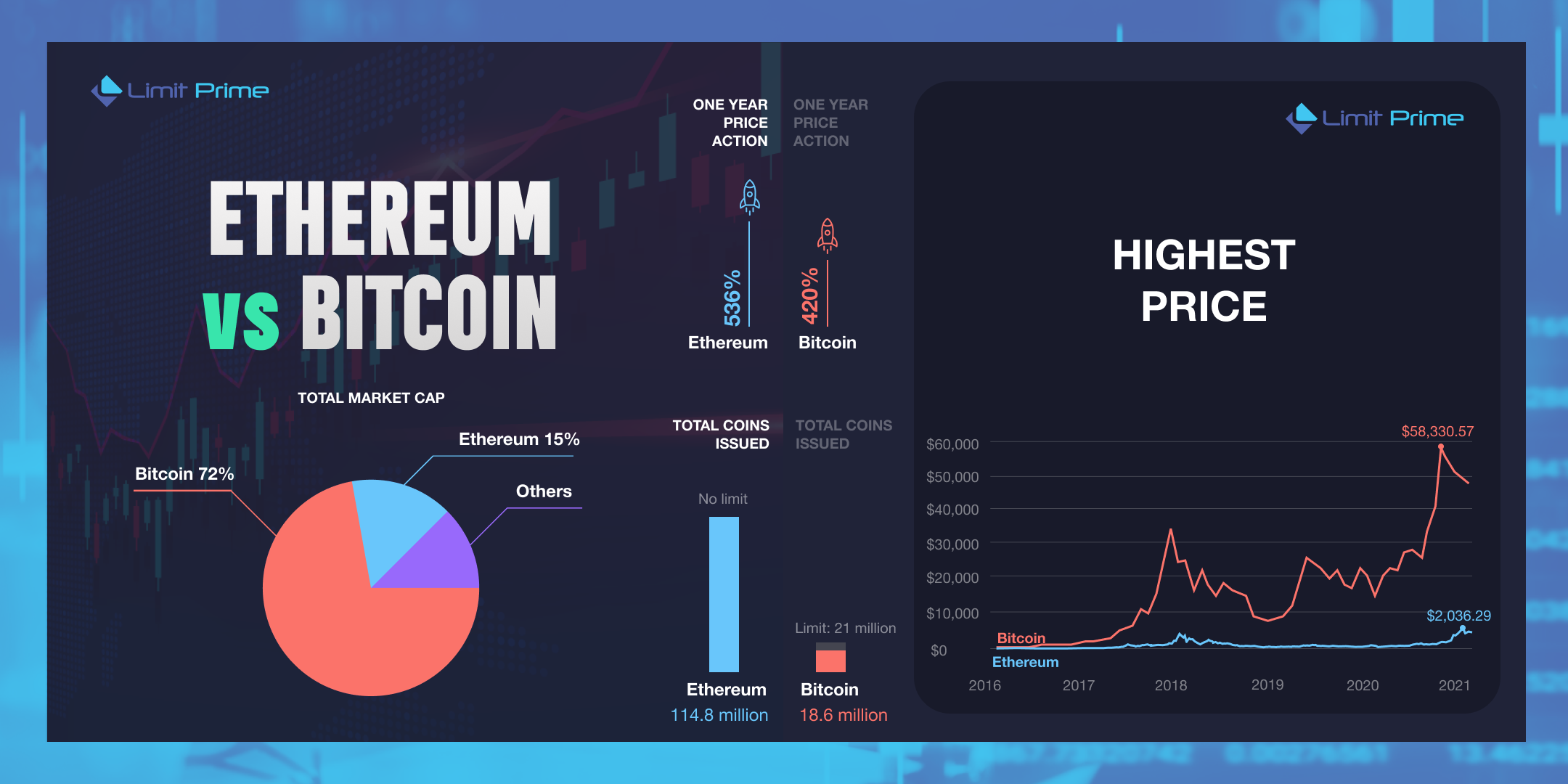

Ethereum and Bitcoin are the two most prominent cryptocurrencies, each offering unique features and functionalities in the blockchain ecosystem. While Bitcoin was created as a digital currency to facilitate peer-to-peer transactions, Ethereum introduced the concept of smart contracts, allowing developers to build decentralized applications (dApps). This fundamental difference sets the stage for how each cryptocurrency is utilized in the market.Historically, Bitcoin has maintained a dominant position in terms of market capitalization, often exceeding that of Ethereum significantly.

However, Ethereum’s market cap has seen substantial growth, especially during periods when DeFi (Decentralized Finance) projects gained popularity, which made Ethereum a more appealing investment for many. The primary use cases for Ethereum center around its capability to host dApps and smart contracts, while Bitcoin is primarily viewed as a store of value or digital gold.

Market Cap Comparison

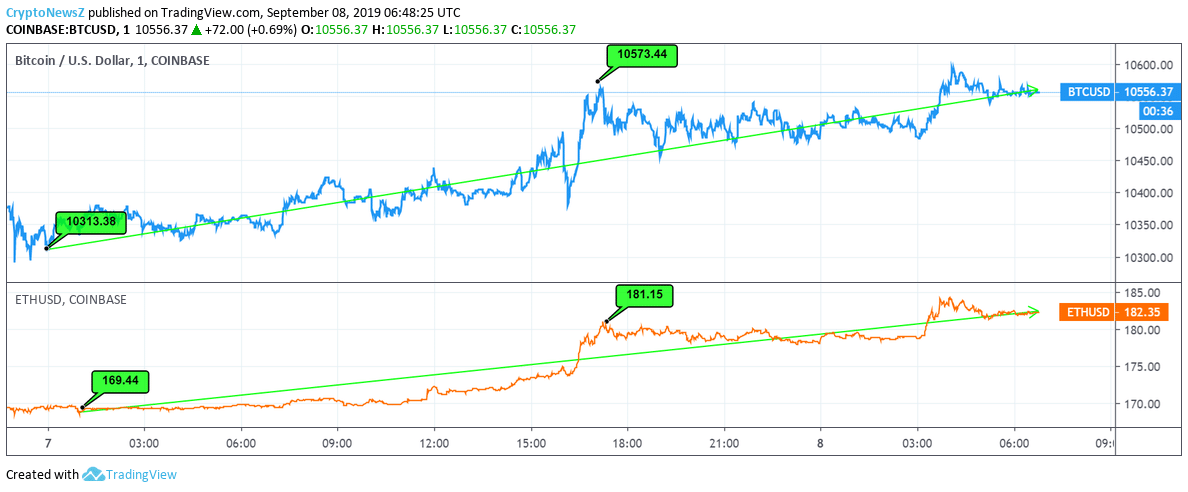

As of the latest data, Bitcoin’s market cap stands at approximately $450 billion, while Ethereum’s market cap has reached around $220 billion. This stark contrast illustrates Bitcoin’s ongoing dominance in the cryptocurrency market, although Ethereum’s value is gaining traction due to its diverse range of applications.Several factors influence the fluctuations of market caps for both cryptocurrencies. Market sentiment, regulatory news, and technological advancements play a significant role.

The table below showcases the market cap of Bitcoin and Ethereum over the past year, highlighting their performance during various major events in the crypto space.

| Month | Bitcoin Market Cap (in Billion USD) | Ethereum Market Cap (in Billion USD) |

|---|---|---|

| October 2022 | 400 | 150 |

| January 2023 | 450 | 180 |

| April 2023 | 550 | 250 |

| July 2023 | 480 | 220 |

| October 2023 | 450 | 220 |

Investment Trends

The investment landscape for Bitcoin and Ethereum has evolved, with both retail and institutional investors showing interest in these cryptocurrencies. Retail investors often gravitate towards Bitcoin for its established reputation, while institutional investors are beginning to diversify their portfolios by including Ethereum, primarily for its utility in smart contracts and dApps.Market cap has a significant impact on investment decisions. Investors often view a higher market cap as an indicator of stability and longevity.

For instance, large investments in Ethereum during the DeFi boom highlighted its potential, with firms like Grayscale launching Ethereum-focused investment products, reflecting the growing institutional adoption.

Future Forecasts

Experts predict that both Bitcoin and Ethereum are poised for substantial market cap growth in the coming years. Bitcoin’s scarcity, driven by its capped supply of 21 million coins, continues to attract long-term investors. Meanwhile, Ethereum’s transition to proof-of-stake and the development of scalability solutions such as sharding could significantly boost its market cap.Technological advancements are crucial for the future of both cryptocurrencies.

The Ethereum 2.0 upgrade aims to enhance network efficiency, while Bitcoin’s Lightning Network seeks to improve transaction speeds. Comparative analyses of expert predictions indicate varying perspectives; some foresee Bitcoin solidifying its status as digital gold, while others believe Ethereum could surpass Bitcoin in market cap as its ecosystem expands.

Regulatory Impact

Regulation plays a vital role in shaping the market cap of Bitcoin and Ethereum. Recent regulatory developments, such as the approval of Bitcoin ETFs in several jurisdictions, have positively influenced Bitcoin’s market perception. In contrast, Ethereum faces scrutiny regarding its classification as a security or commodity, which could impact its market dynamics.Regulators in different regions perceive market cap differently. In the United States, the SEC’s approach to cryptocurrencies has evolved, leading to increased clarity.

In contrast, other regions may impose stricter regulations, affecting market cap and investment behavior.

Community and Ecosystem Development

The communities surrounding Bitcoin and Ethereum play a crucial role in their market cap. Developers, enthusiasts, and investors contribute to the growth and innovation within these ecosystems. Ethereum, in particular, benefits from a vibrant developer community that continuously works on new projects, enhancing its utility and market appeal.Upcoming projects within the Ethereum ecosystem, such as Layer 2 solutions, aim to address scalability challenges, potentially boosting its market cap.

Key community initiatives that impact both cryptocurrencies include:

- Bitcoin Improvement Proposals (BIPs) focusing on network upgrades.

- Ethereum’s EIPs (Ethereum Improvement Proposals) that enhance its functionality.

- Community-led educational efforts to promote adoption and understanding.

Technological Challenges

Both Ethereum and Bitcoin face technological challenges that could impact their market cap. Scalability issues are particularly significant; Bitcoin struggles with transaction speed during peak times, while Ethereum has faced congestion due to high demand for dApps and NFT transactions.Innovations such as Bitcoin’s SegWit and Ethereum’s ongoing upgrades aim to overcome these challenges. For example, Ethereum’s shift to proof-of-stake not only enhances scalability but also addresses environmental concerns associated with energy-intensive mining processes.

Market Sentiment and Social Media Influence

Market sentiment heavily influences the market cap of both Ethereum and Bitcoin. Social media trends can quickly shift public perception, leading to significant market movements. Viral events, such as a high-profile endorsement or a negative news story, can lead to rapid changes in market cap.Influencers play a pivotal role in shaping the dynamics of both cryptocurrencies. Their endorsements or criticisms often lead to increased interest or skepticism among potential investors, showcasing the power of social media in the cryptocurrency landscape.

Last Point

In conclusion, the ongoing analysis of the ethereum and bitcoin market cap not only reveals the current state of these digital currencies but also hints at their future trajectories. As technological advancements and regulatory landscapes shift, staying informed will be essential for making prudent investment decisions and understanding the potential impacts on market sentiment.

Query Resolution

What is the current market cap of Bitcoin?

The current market cap of Bitcoin is approximately $600 billion, but this figure fluctuates with market conditions.

How does Ethereum’s market cap compare to Bitcoin’s?

Ethereum’s market cap is currently around $220 billion, significantly lower than Bitcoin’s, but it has been growing rapidly.

What factors influence the market cap of these cryptocurrencies?

Factors include technological advancements, regulatory changes, market sentiment, and macroeconomic trends.

Can the market cap of Bitcoin and Ethereum change dramatically?

Yes, both cryptocurrencies can experience significant fluctuations based on market sentiment and external events.

What role do institutional investors play in the market cap?

Institutional investors can significantly impact market cap by injecting large amounts of capital, influencing overall market trends.